Introduction

Have you heard about the latest scam hitting the UK insurance industry?

In recent years, fraudsters have actively manipulated digital photos to claim damages that never occurred.

This scam isn’t just a minor issue; it utilises both simple photo editing tools and sophisticated AI technologies.

Why should this concern you?

This deceptive practice not only undermines the integrity of the insurance system but also drives up costs for honest consumers.

- Rise of Image Manipulation: The alarming trend of using editing apps to fabricate damage in insurance claims.

- Impact on Premiums: How these scams are pushing insurance costs higher.

- Technological Deception: Distinguishing between ‘shallowfakes’ and ‘deepfakes’.

- Case Studies: Examples from recent fraud investigations.

- Fighting Fraud: Strategies to combat this growing threat.

Scam: The Surge In Shallowfake Incidents

What’s causing alarm across the insurance industry?

Claims involving manipulated images—shallowfakes—have surged significantly.

From 2021-22 to 2022-23, these incidents have increased by 300%.

But how are they made?

Fraudsters often craft these fakes with just a smartphone and basic software like Photoshop.

This represents a new wave of fraud that is shockingly easy to execute but hard to detect.

Understanding A Shallowfake/Scam

So, what exactly are shallowfakes?

Unlike deepfakes, which AI generates to create fake audio and visual records, shallowfakes require minimal technical skills.

This accessibility allows more fraudsters to exploit the system.

Simple edits, such as adding damage to a vehicle photo, can effortlessly deceive an insurance company.

A Case Study In Deception

Consider this scenario:

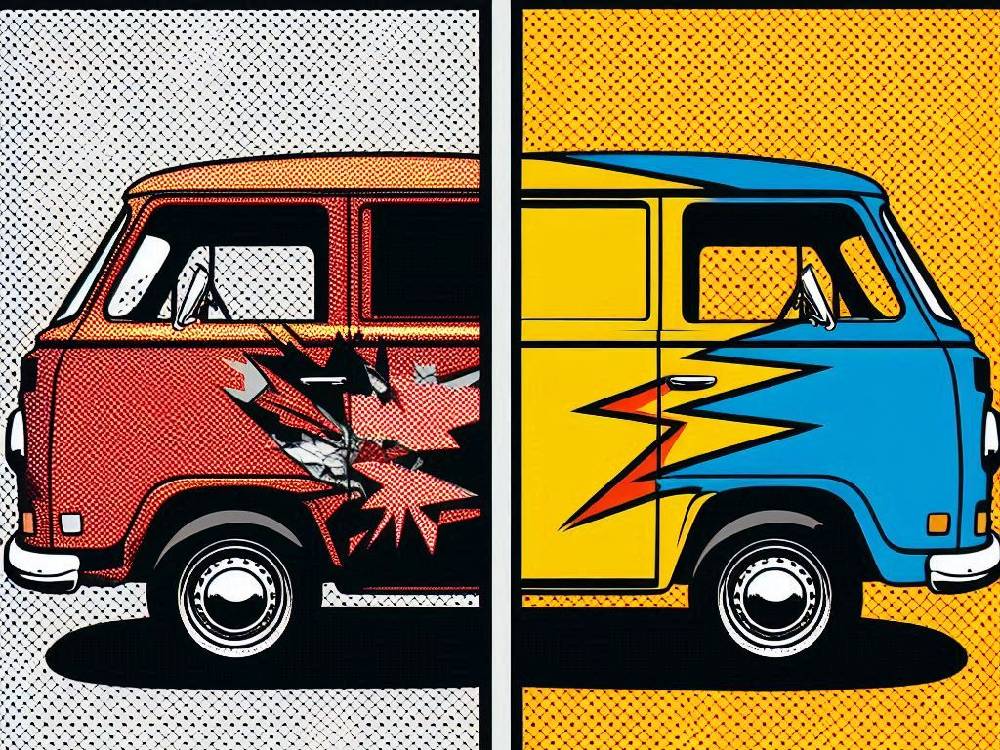

A van, prominently displayed on a business’s social media page, subsequently became the target of a fraudulent insurance claim.

Fraudsters submitted a doctored photo to insurers, showing significant damage.

However, the twist here is that the fraud team discovered the photo was merely edited to show damage.

The Challenge For Insurers

Why is this a big deal for insurers?

Detecting these fakes is increasingly challenging as editing tools improve.

Consequently, insurers must now invest in advanced technology and training.

This necessary investment is costly and impacts premium rates.

Economic And Operational Impacts Of Scam

So, what’s the cost of these scams?

The financial impact is significant, leading to higher claims payouts for non-existent damages.

Additionally, more spending on anti-fraud measures is required.

Ultimately, this financial strain leads to higher premiums for all policyholders.

This section highlights the critical issues of photo manipulation in insurance claims, showing the methods and ease of such frauds, and discussing the broader implications for the industry and consumers.

Isn’t it clear why the need for enhanced vigilance and technology has never been greater?

Rising Trends In Insurance Fraud

Moreover, as technology evolves, so does the sophistication of insurance fraud.

Deepfakes are now entering the arena, enabling fraudsters to create more complex and believable fake claims.

These advanced fakes often involve entirely fabricated reports and estimates, which present a severe challenge for insurance companies.

Legal And Technological Countermeasures

Furthermore, the insurance industry is fighting back with both legal and technological measures.

Regulations are tightening, and software solutions are becoming more advanced to detect these fraudulent activities.

Insurance companies are also collaborating with tech companies to develop solutions that can spot inconsistencies in digital submissions more effectively.

Insights From Industry Experts

Additionally, industry experts are providing valuable insights into future trends and potential threats.

They predict that as technology becomes more accessible, the frequency and creativity of insurance fraud will likely increase.

This calls for ongoing adaptation and enhancement of fraud detection systems.

Conclusion

To sum up, the rise of photo manipulation in insurance claims poses significant challenges and costs to the industry and consumers alike.

Moreover, it highlights the urgent need for continuous innovation in fraud detection technologies.

For more information on how to protect yourself from such scams, visit our blog on insurance fraud prevention.

As we move forward, staying informed and vigilant will be crucial in combating these sophisticated scams.

Isn’t it clear that the battle against insurance fraud is more vital than ever?