Introduction

Not a mechanic, and not even a traffic warden—surprisingly, it was a nine-year-old boy.

Moreover, this incredible story clearly illustrates why safeguarding your van, along with everything it carries, is absolutely essential.

Here’s what this article will cover:

- A heroic tale that underlines the risks van owners face.

- The importance of comprehensive van insurance.

- How you can protect your vehicle without breaking the bank.

- Proven tips to find the cheapest van insurance in the UK.

Let’s dive in.

The Superhero Who Saved The Day

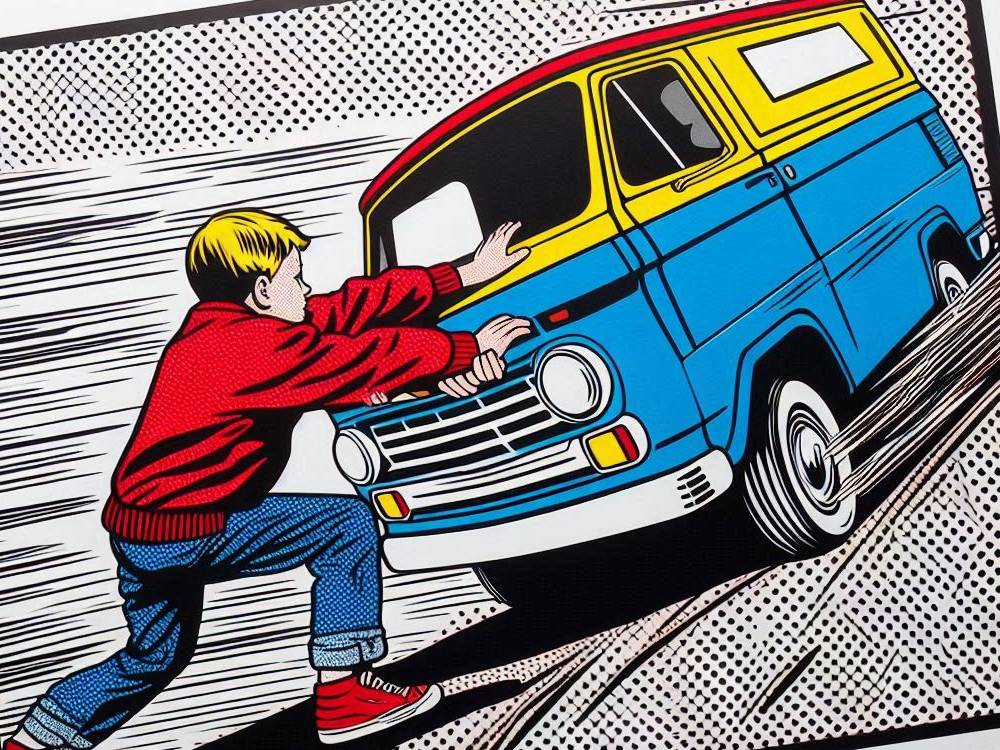

In Lancashire, a nine-year-old boy named Kameron Hunter did something extraordinary.

While playing football outside his home, Kameron noticed a neighbour’s van—loaded with tools—rolling down the street.

Without hesitation, he ran towards the vehicle and used his bare hands to stop it.

For 10 nerve-wracking seconds, Kameron held the van in place until the owners arrived.

His quick thinking and bravery prevented what could have been a disastrous crash into nearby cars.

But the incident reveals more than just his courage.

It also highlights the unpredictable nature of van ownership and the potential costs of accidents.

What Can We Learn About Van Safety?

Stories like Kameron’s remind us of one thing: accidents can happen anytime.

Whether due to mechanical failures, like a brake fault in this case, or driver oversight, the risks are real.

In fact, having the right insurance is crucial because it ensures you’re not burdened with enormous repair bills.

Furthermore, even for seemingly minor accidents, a good insurance policy can provide coverage for:

- Vehicle damage.

- Damage to nearby properties.

- Loss of tools or equipment stored in your van.

Without proper coverage, however, you’re ultimately left footing the bill.

Moreover, that’s a risk no van owner can afford to take.

The Real Cost of Cheap Van Insurance

It’s tempting to choose the cheapest option when insuring your van.

But beware of policies that offer minimal coverage.

In addition, the right plan not only helps you save money but also plays a vital role in safeguarding your livelihood.

To ensure you’re fully covered, make sure to look for policies that include the following:

- Coverage for tools and cargo.

- Protection against theft and vandalism.

- Repairs for mechanical faults.

Are you driving a car or a van? Check your insurance policy.

Choosing wisely ensures peace of mind, especially when unexpected situations arise.

Balancing Affordability And Coverage

Here’s how to strike the perfect balance:

- Compare multiple providers for competitive rates.

- Use telematics to monitor driving behaviour and earn discounts.

- Consider multi-van policies for business fleets.

These steps reduce costs while ensuring you remain fully covered.

Need more tips? How telematics devices can save you money on van insurance.

How To Find The Cheapest Van Insurance In The UK

Protecting your van doesn’t have to cost a fortune.

By taking a strategic approach, you can secure cheap insurance without compromising on coverage.

This ensures you get affordability and protection together.

Here are proven tips:

- Telematics Policies:

Install a telematics device to monitor your driving habits. Safer driving can lead to lower premiums.

Learn more: How telematics devices can save you money on van insurance. - Avoid Costly Modifications:

Fancy upgrades might look good, but they can significantly increase your insurance costs.

Understand what counts: What counts as a modification for van insurance? - Bundle Policies:

If you own more than one vehicle, bundling policies can save money and simplify your renewals. - Shop Around:

Compare quotes online to ensure you’re getting the best deal. Using comparison tools is a game-changer.

Why Proactive Measures Matter

Kameron’s story highlights the unpredictable nature of owning a van.

While his bravery saved the day, not every situation will have a superhero nearby.

By taking a proactive approach to maintenance, you can greatly reduce the risk of unexpected problems with your van.

Additionally, having proper insurance ensures you are well-prepared to handle any potential mishap that may arise.

As a result, these steps help you address unexpected issues confidently and minimise risks effectively.

With these steps, you can handle unexpected issues confidently.

Here’s what you can do today:

- Regularly service your van to avoid mechanical failures.

- Check your policy details to ensure your tools, cargo, and vehicle are adequately covered.

- Opt for additional features like breakdown cover for extra peace of mind.

Why Proper Vehicle Compliance Is Crucial For Road Safety

Conclusion

Accidents, whether caused by mechanical faults or human error, can happen at any time.

Kameron’s heroic actions remind us of the importance of being prepared.

Choosing the right van insurance not only protects your van but also ensures peace of mind.

By following the tips outlined here, you can find cheap van insurance in the UK without sacrificing coverage.

Above all, remember that it’s not just about saving money;

Rather, it’s also about taking the necessary steps to protect what matters most.

For more insights and practical advice, check out these related blogs:

- 10 Simple Hacks To Instantly Lower Your Van Insurance And Save Big.

- Why 57% of UK Van Owners Are Facing Insurance Hikes in 2024.