Van drivers: By now you should know what you can and can’t do whilst driving a vehicle.

Any vehicle, not just a van.

It does seem though, that some folks need to be constantly reminded of these facts, as some of our weekly stories illustrate.

Hands-Free Or Not At All

Holding your mobile phone whilst driving is a definite no-no; especially more so since the recent changes to the Highway Code.

However, one driver in Pembrokeshire was recently fined £220 plus costs of £90.

He also had the privilege of having 3 points on his driving licence.

Police charged the driver with “not being in proper control of a vehicle,” a Transit van.

They had spotted him using his phone while driving.

The driver also failed to attend the court hearing!

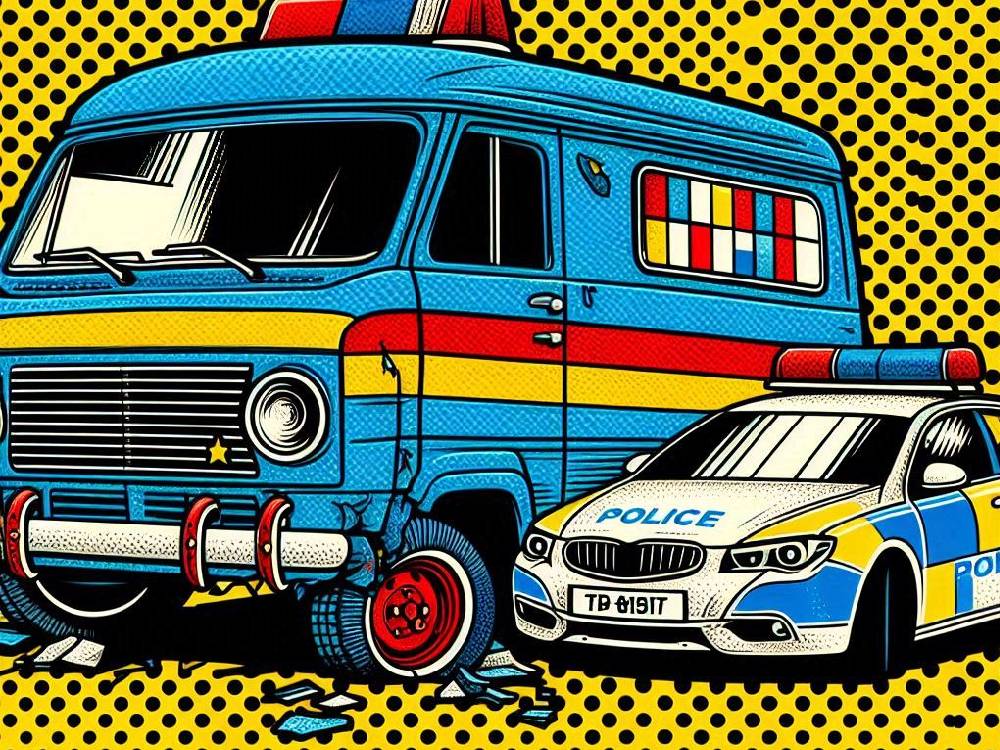

Dangerous Driving

Thames Valley Police recently sentenced another van driver to 18 months in prison after chasing and finally catching him.

The driver had been speeding at 90mph on the M40 and continued at this speed on the A40 after leaving the motorway.

Driving erratically and endangering other road users, the driver tested positive for drugs.

He also lacked a valid driving licence and van insurance.

Motorists Keeping North Yorkshire Police Busy

A team of officers in an unmarked police vehicle observed a van driver.

They were there to target lawbreakers on the roads, in this case, the A1M near Wetherby.

Not only was the driver in question not wearing a seatbelt, but he was also using his mobile phone.

When he saw the officers filming him, he reacted by sticking two fingers up at them.

Unsurprisingly, authorities fined him £200 and added 6 penalty points to his licence.

On Patrol In Harrogate

North Yorkshire Police recently patrolled and decided to investigate a white van and its driver at a roadside stop.

One officer instinctively sensed something was off, although they initially stopped the van for defective lights.

They investigated further and discovered the vehicle lacked tax, had no valid MOT, and the driver’s licence was revoked.

A definite case of “you’re nicked, sunshine”.

Don’t take any chances, and don’t get caught out without insurance.

Have a quick check for the best and cheapest van insurance quotes for your van.

Simply begin by completing this quick 3-minute form.