Introduction

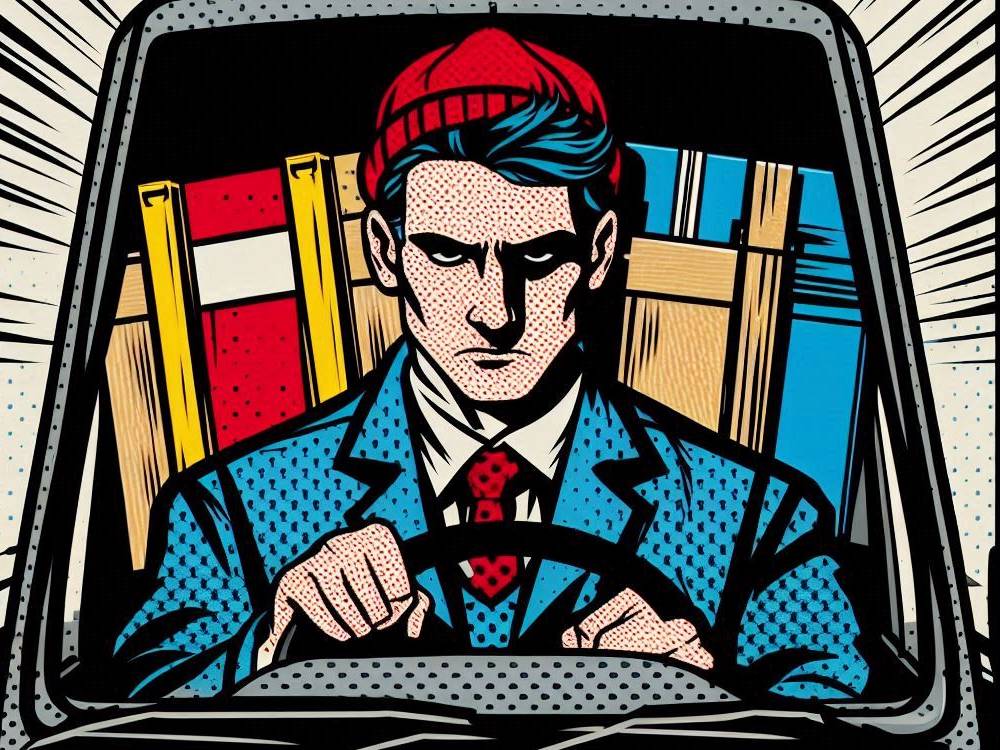

Police stop.

Sometimes, headlines hit harder than you expect.

This is one of those times.

After being spotted by police with cloned plates, a Wolverhampton van driver then fled on foot — ultimately abandoning a woman and a small baby inside the van.

He had no insurance.

No tax.

And no MOT.

Just recklessness that could have ended in tragedy.

Wolverhampton Police Incident: A Shocking Wake-Up Call

Imagine leaving a baby behind to run from police.

That’s the grim reality officers faced when stopping a van on cloned plates in Wolverhampton.

The man driving?

Gone — fleeing into the night, leaving a woman and a small child completely vulnerable.

Worse still, the van had no insurance, no MOT, and no tax.

It was a ticking time bomb on wheels.

If there had been a crash?

The consequences don’t even bear thinking about.

You can read more about how crucial it is to keep your vehicle compliant right here.

Why Van Insurance Matters More Than Ever

It’s easy to think, “It won’t happen to me.”

But here’s the thing:

Every uninsured driver adds risk to the roads we all share.

Driving without insurance doesn’t just mean fines and points.

It can mean criminal charges, prison time, and — as in this case — social services getting involved to protect vulnerable children.

Worse still, if you cause a collision while uninsured, you’re personally liable.

That could mean bankruptcy or worse.

Protect yourself and your family with cheap van insurance UK.

Because when the worst happens, you’ll be glad you did.

The Hidden Risks Of Cloned Plates

Let’s lift the lid on cloned plates.

Cloning happens when criminals copy a van’s legitimate number plate onto a stolen or illegal vehicle.

To the untrained eye?

It looks like just another ordinary van.

But behind the scenes, it could be hiding theft, tax evasion, or serious insurance fraud.

Here’s the kicker:

If your van gets cloned, you could face legal headaches — unless you spot it fast.

Tips to avoid getting caught out:

- Double-check your registration paperwork

- Fit dash cams and trackers

- Check online if your number plate crops up unexpectedly

Want to see how the rising theft crisis is affecting insurance costs?

Find out here.

Police Safeguarding Families On The Road

This story wasn’t just about cloned plates.

It was about a baby’s safety.

And a woman left abandoned in a dangerous situation.

When police discovered the child, they immediately referred the case to children’s safeguarding services.

Because protecting vulnerable lives isn’t optional — it’s essential.

Because of this, as a driver, you carry responsibility for every passenger you transport.

After all, skipping insurance isn’t just illegal; it’s a betrayal of the trust every passenger places in you.

You can help protect your family and others by using tools like dash cams.

Every bit of vigilance matters.

Compliance Is Key: Stay Legal, Stay Safe

You might think,

“Skipping an MOT or delaying insurance saves money.”

Spoiler alert:

It doesn’t.

Without the right paperwork in place, therefore, you’ll quickly find yourself facing penalties, court appearances, and soaring future insurance costs.

Even worse, if you’re involved in a crash?

Because of that, your lack of compliance could destroy lives — including your own.

Don’t cut corners.

Learn why staying compliant is so important.Your future depends on it.

How To Find The Cheapest Van Insurance Without Compromising Safety

First things first, finding cheap van insurance doesn’t mean you have to cut corners.

On the contrary, smart shopping could actually land you better cover at a lower price.

To begin with, always compare multiple quotes.

Think about adding telematics devices.

These clever little “black boxes” monitor your driving and reward safe behaviour with cheaper premiums.

In addition, boosting your van’s security — for example, installing alarms, immobilisers, or trackers — often leads to instant savings.

If you want to dig even deeper, here’s how telematics devices could save you serious money.

Clearly, saving money is not just about luck — it’s about making smart choices.

Police Operation Snap: Your Role In Safer Roads

Now, moving on to something equally important — keeping our roads safe for everyone.

Thanks to Operation Snap, reporting reckless drivers is now easier than ever before.

Whenever you catch dangerous behaviour on dash cam or helmet cam footage, you can upload it directly to the police.

More importantly, West Midlands Police act on over 80% of these submissions, making a real difference.

Therefore, every video you send could stop an accident before it happens.

Wouldn’t that be worth the few minutes it takes?

All things considered, reporting unsafe drivers could save lives — maybe even your own.

The Bigger Picture: Safer Communities Start With You

Now that we’ve seen how individuals can help, let’s zoom out and look at the bigger picture.

Truthfully, road safety isn’t just a police responsibility.

Instead, it’s a shared mission — one that starts with drivers like you.

Every time you renew your insurance, get an MOT, or drive cautiously, you’re doing your part.

On the other hand, neglecting these duties puts everyone at risk.

At the end of the day, van insurance isn’t just about ticking a box.

Instead, it’s about committing to a safer, more responsible driving culture.

Without doubt, your actions today could protect countless lives tomorrow.

Conclusion

All things considered, the Wolverhampton story stands as a powerful reminder:

In reality, responsibility isn’t optional — it’s absolutely essential.

Without insurance, tax, and MOTs, you’re not just risking your own safety.

Instead, you’re gambling with the lives of everyone around you.

Fortunately, getting protected doesn’t have to be expensive.

By planning carefully and shopping smartly, you can still find cheap van insurance without ever having to sacrifice good cover.

Before you hit the road again, ask yourself:

“Am I really doing everything I can to drive safely and legally?”

If you’re ready to dig even deeper, take a look at these helpful resources:

- Are You Driving a Car or a Van? Check Your Insurance Policy

- How a Simple Van Upgrade Could Slash Your Insurance Rates

- Why 57% of UK Van Drivers Are Facing Insurance Hikes

In the end, the safest journey begins with a single decision — to drive responsibly and stay protected.